Steps to Starting Your Business Successfully

A General Overview of Starting a Business

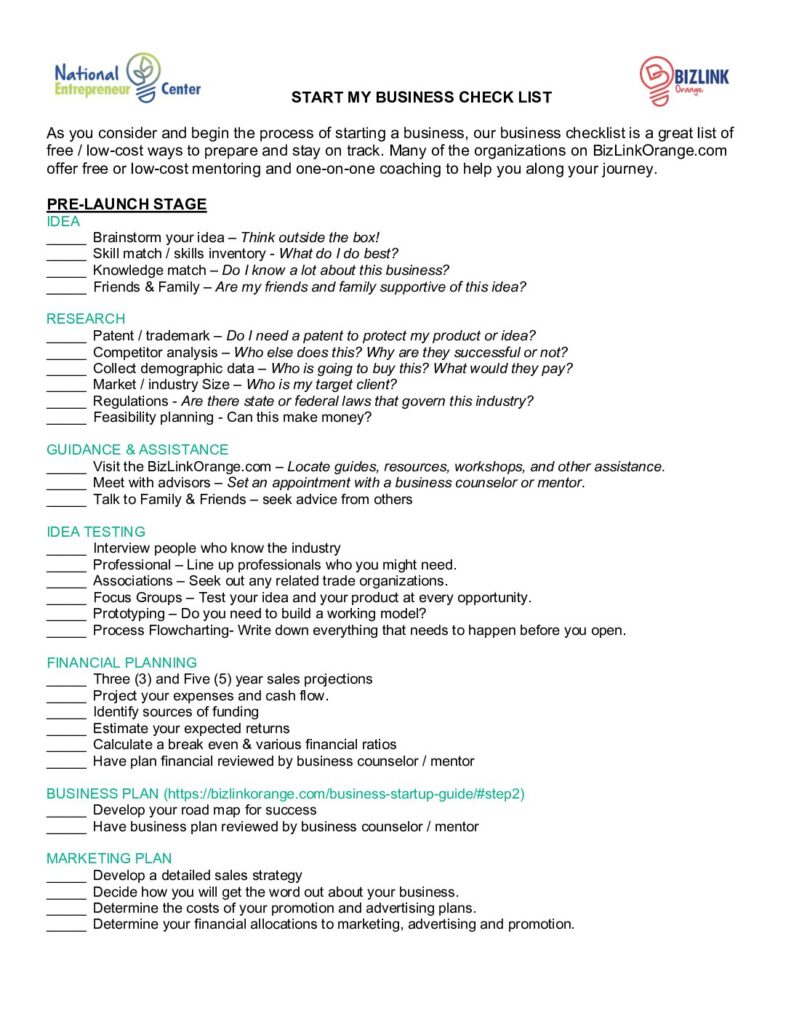

Ideas are everywhere. Successful entrepreneurs know that not every idea is a good business opportunity, so before you bet the ranch on your idea, take the time to research your idea, develop a strategy, and craft a winning business plan. Get input on your plan along the way and connect with the local resources that are available and ready to assist you along the way!

Research Your Idea

- Do you know who will buy your product or service?

- What will people pay for your product or service?

- Have you determined your total costs?

- Who are your competitors?

While preparing your startup endeavor, be sure to research and understand the market that you will be entering.

Where Will Your Business Be Located?

Look into zoning and licensing rules, as well as permits and planning for the city &/or county prior to signing any lease agreements to ensure your business can legally operate in that location. This can also include homebased businesses, as some homes are not zoned for businesses.

Best to consider while working on your business plan and before registering your business.

The Research Guide offers links to data and helpful tips such as the US Census, Orange County Library System, and Data Axle/Reference USA at the National Entrepreneur Center.

Plan Your Business

Write your Business Plan

For any business, the first step is to turn your basic idea into a written, viable plan of action. A well-thought out business plan is necessary for obtaining loans and is a model for your success.

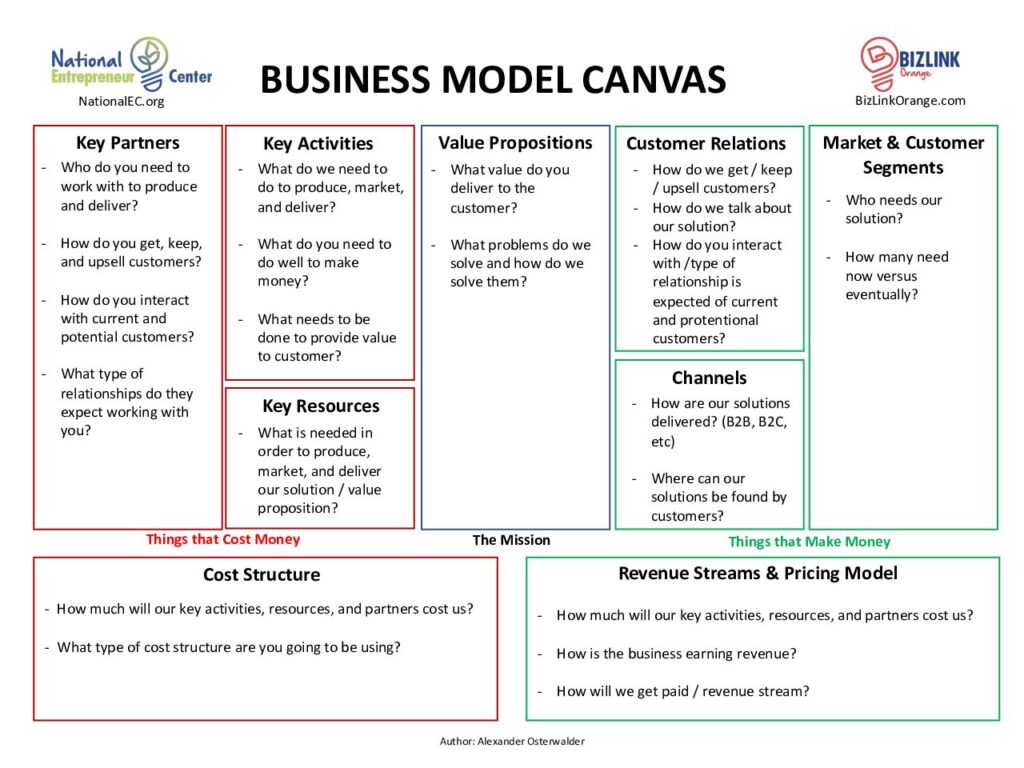

Current trends show shorter, more precise Business Plans (no more than 15 pages). Some accept Lean Business Plans and Business Model Canvas.

Good business planning keeps you focused and can be the difference between failure and success.

A plan in your head is good. A plan on paper is even better!

Create Your BLAIM team

A trusted team of professionals can help avoid stumbling blocks while starting and growing your business.

Banker

Lawyer / Attorney

Accountant

Insurance Agent

Mentor

Network with current business owners you trust and/or contact your local Small Business Development Center or area chamber for recommendations and introductions.

***It is recommended that you consult with an Accountant and Attorney/Lawyer to ensure you fully understand the liability and implications of the legal business structure chosen.***

Decide Legal Business Structure

No matter what kind of business you will be developing, you will want to make sure your business is established legally. The first step is to decide what kind of business entity (legal structure) is best for you.

The Legal Business Structure Guide provides details to help you decide which would be best for your business.

Careful consideration must be given to the management, structural and tax implications of your decision. While not a replacement for sound legal or tax advice, see the SBA’s tips of Selecting a Business Structure.

There are several items to consider if you decide to incorporate your business. Additionally, there may be a variety of items that determine how your business can operate legally in the State of Florida and your local municipality. The Zoning & Licensing Guide can assist in learning specifics in each city.

Forms of a Business Organization

One of the first decisions that you will have to make as a business owner is how the business should be structured. All businesses must adopt some legal configuration that defines the rights and liabilities of participants in the business’s ownership, control, personal liability, life span, and financial structure. This decision will have long-term implications, so you may want to consult with an accountant and attorney to help you select the form of ownership that is right for you.

In making a choice, you will want to consider the following:

- Your vision regarding the size and nature of your business.

- The level of control you wish to have.

- The level of “structure” you are willing to deal with.

- The business’s vulnerability to lawsuits.

- Tax implications of the different organizational structures.

- Expected profit (or loss) of the business.

- Whether or not you need to re-invest earnings into the business.

- Your need for taking cash out of the business for yourself.

The four basic legal forms of business organization:

- Sole Proprietorship

- Partnerships

- Corporations

- Limited Liability Company

Register Your Business

To operate legally in the state of FLorida, you must be registered with the State of Florida.

Some industries require additional license or business registration paperwork to be completed. It is also important to check with city/town & county governments where you intend to do business to determine licensing and zoning requirements – before signing a lease or buying property.

The BizLink Orange Licensing & Zoning Guide provides direct links to state, county, and municipalities for license requirements and Business Tax Receipts and Zoning requirements.

Obtaining Necessary Tax Information

Taxation for small businesses may be simple or complex, depending on the size and business structure. The tax liability for each business will be different and you should consult your attorney and accountant regarding comprehensive tax planning.

Employer reporting requirements and responsibilities

As an employer, you will be responsible for additional employment insurance and worker’s compensation insurance. This includes applying for federal and state withholding numbers.

- For Federal Identification Numbers (EINs) contact the Internal Revenue Service or call (800) 829-4933

- For State Sales Tax and State Withholding Tax contact the State Department of Revenue.

Identify Sources of Financing

Once your business has been registered, you will need to open a Business bank account. Often banks require the EIN number to open the account.

Refer to the funding guide for more information on the variety of funding opportunities most often used.

You can search the Regional Resources for organizations that provide funding assistance.

Consider Insurance Options

There are several types of insurance that should be considered or could be required:

Business / Property – protects you financially against a variety of losses your business can occur for a premium payment. This includes loss of property due to fire, theft, or damage.

Life / Health / Casualty– Available to you and team members for personal use.

Workers Compensation – required by some businesses

Choose an Insurance Company and Agent you are comfortable with and who will:

- Show you how to minimize risks

- Communicate on updating your coverage when changing needs occur

- Protect you against risks to your company’s property

Look for an agent with experience in helping to achieve your goals and objectives and who will provide you will regular updates. This is often a well established agent from a financially-sound company of high ratings.

Learn & Grow

Continue to take classes and attend networking events. View calendar of events

Additional Help & Materials

- 20 questions You Can Ask to Validate Your Startup Idea (Entrepreneur Magazine)

- Evaluate Your Idea checklist (Princeton Creative Research)

- Buying a Franchise (Entrepreneur Magazine)

- How to Choose the Right Franchise for You (Business News Daily)